UPDATE: Hill & Smith (LSE:HILS) emerges as a top contender for passive income investment following the UK government’s recently unveiled £120 billion infrastructure spending plan. This development, announced during the Autumn Budget last month, signals a significant opportunity for investors seeking long-term gains.

This funding initiative focuses on critical improvements to Britain’s roads, rail, energy, and housing sectors, marking a pivotal moment for infrastructure companies. As a leading supplier of steel and road safety equipment, Hill & Smith is strategically positioned to capitalize on these new investments, which could transform its financial landscape.

Hill & Smith has already been riding a wave of increased infrastructure spending from the US, where over $1 trillion is currently being invested. The company’s ability to meet rising demand has empowered management to enhance pricing strategies, resulting in impressive profit margins. Over the last five years, revenue growth has averaged around 7%, while earnings have surged by 22%.

The ramifications are clear: the dividend per share has skyrocketed from 10.6p in early 2020 to 50.5p today, reflecting a staggering 376% increase. Although Hill & Smith currently offers a 2.2% dividend yield, analysts suggest this could rise significantly if the company continues its robust performance.

Investors are advised to keep a close watch on the company’s operations, particularly its successful US ventures, which have allowed it to thrive amidst tariff challenges. However, the situation is less favorable in the UK, where prior infrastructure spending has lagged, especially for road safety solutions. The government’s promise of robust funding is promising, but lingering concerns about public finances raise questions about actual implementation.

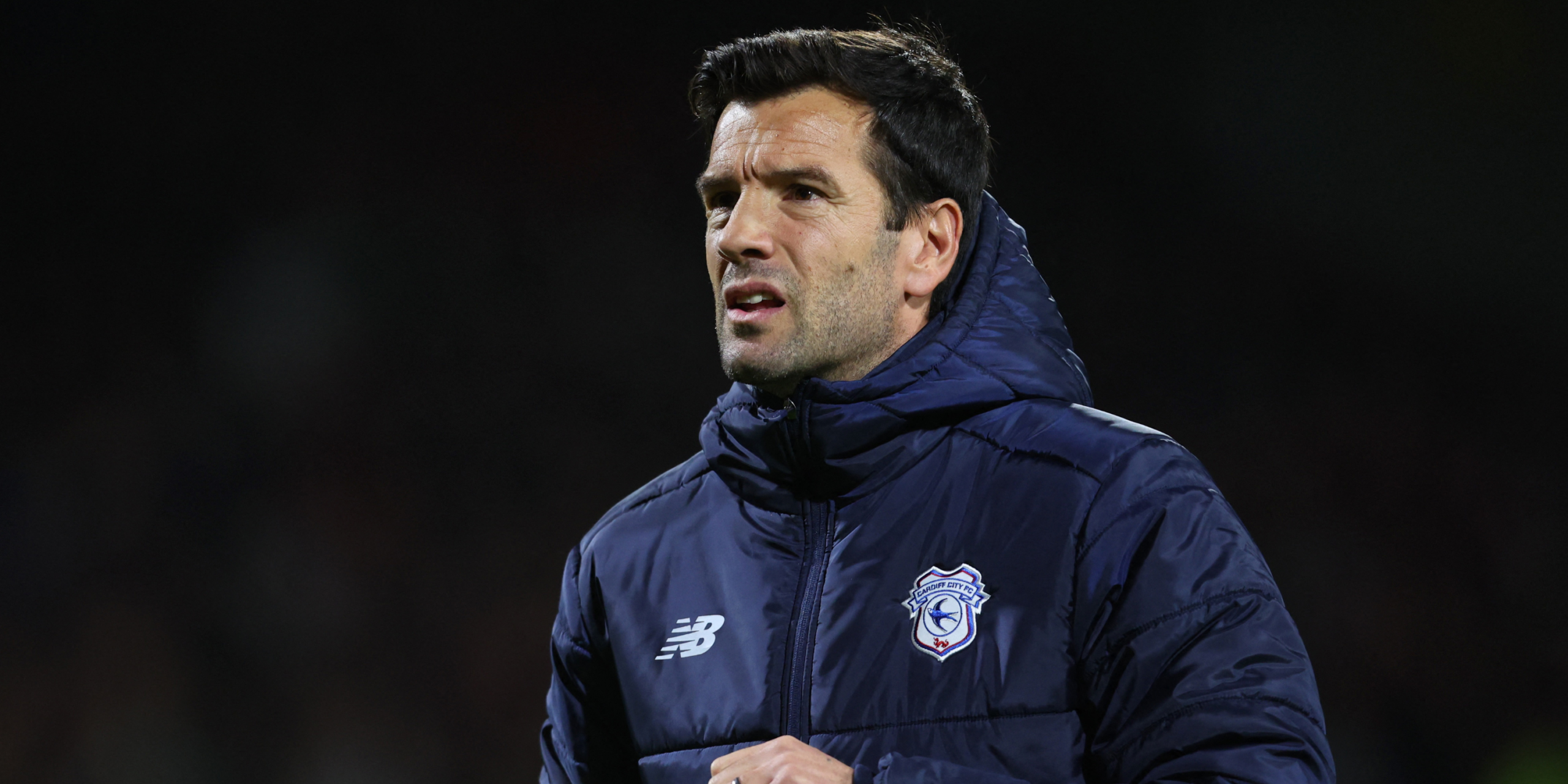

“Despite short-term risks, Hill & Smith’s proven resilience through economic cycles makes it a compelling option for income-focused investors,” said investment expert Mark Rogers.

While there are uncertainties surrounding the UK’s capacity to deliver on the £120 billion plan, Hill & Smith’s track record over its 200-year history suggests strong operational capabilities. This adaptability could set the stage for significant growth and income prospects moving forward.

In addition to Hill & Smith, Rogers identifies six other standout stocks that investors should consider as they navigate the dynamic investment landscape. As the market reacts to these unfolding developments, now is the time for investors to assess their portfolios and consider the potential of income stocks like Hill & Smith.

Stay tuned for more updates as the situation evolves, and don’t miss the opportunity to explore how these developments could impact your investment strategy.