UPDATE: Analysts are buzzing as BP’s (LSE:BP.) share price is projected to soar by 18% in 2026, with average targets hitting 501.1p per share. This news comes after a solid 7% gain in 2025, despite challenges from plunging oil prices and significant boardroom changes.

Just announced, 28 analysts are weighing in on BP, reinforcing the sentiment that the company is poised for a breakthrough. The recent strategic pivot—shifting focus from green energy to fossil fuels—has bolstered investor confidence, suggesting BP is on a path to recovery.

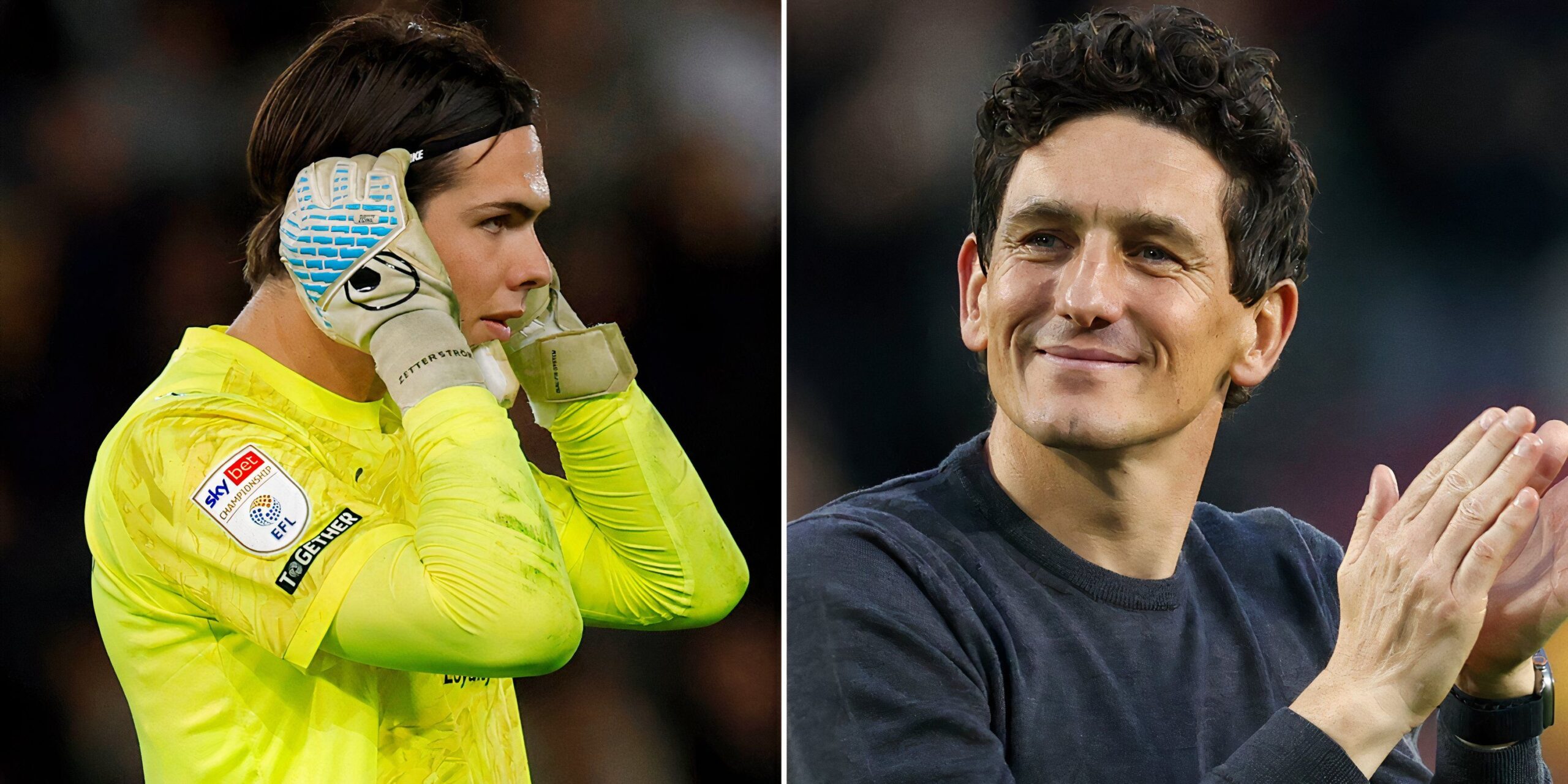

In a bold move, BP appointed Albert Manifold as chair in July and announced Meg O’Neill, formerly of Woodside Energy, will take over as CEO in April. Manifold emphasized that O’Neill’s leadership will help BP become “a simpler, leaner, and more profitable company.” O’Neill’s track record in oil and gas investments, particularly in the U.S., positions her as a strategic fit for BP’s new direction.

Meanwhile, BP has been actively selling off non-core assets, including a 65% stake in its Castrol motor oil division for around $6 billion, to streamline operations and strengthen its balance sheet amid ongoing financial scrutiny.

However, concerns loom as oil prices continue to drop. Brent crude is currently trading below $60 a barrel, its lowest since early 2021, raising alarms about future revenue. Experts at JP Morgan warn that prices could fall into the $30s by 2027, citing an oversupply of oil driven by increased production from both OPEC+ and non-OPEC+ countries.

Investors must also consider BP’s significant debt, currently at $26.1 billion, which raises questions about the company’s financial stability under the new leadership. Analysts remain divided; while some are optimistic about BP’s recovery, others caution that the stock might face a sharp decline in 2026.

In conclusion, BP shares are currently trading at a forward price-to-earnings (P/E) ratio of 11.7, slightly above the 10-year average. While analysts are predicting a potential rise, cautious investors may want to reevaluate their positions. As the market watches closely, BP’s next steps will be pivotal in determining its future trajectory.

Stay tuned for further updates on BP’s strategic moves and market performance as the situation develops.