Saudi Arabia has entered into agreements with the Syrian Petroleum Company aimed at reviving and developing Syria’s oil and gas fields. This initiative is part of a strategic effort influenced by Western powers, particularly the United States and the United Kingdom, following the removal of President Bashar al-Assad in December 2022. Rather than pursuing a traditional military intervention, Western planners are opting for a reconstruction model led by powerful Arab states, with significant involvement from Western firms.

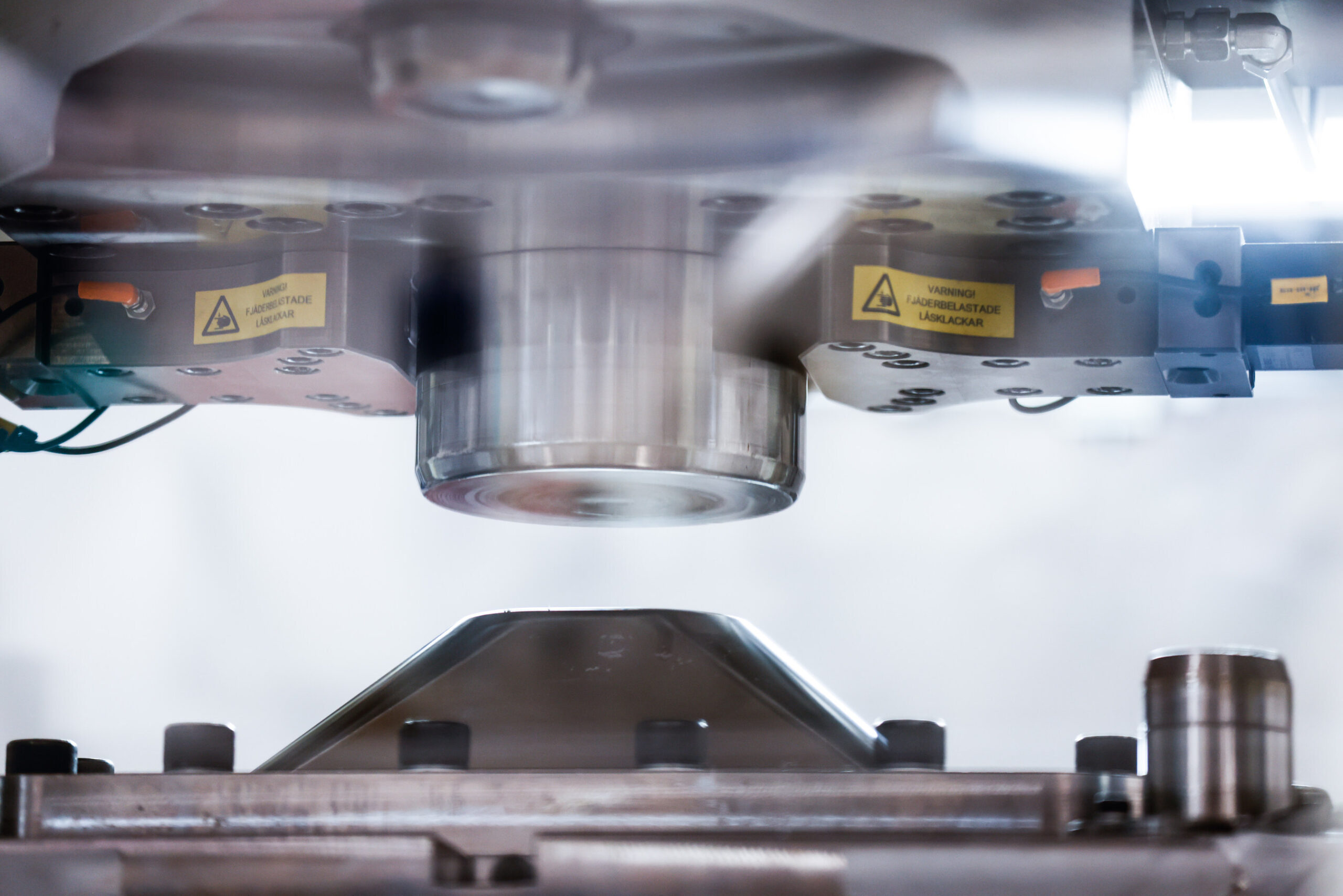

The agreements between Saudi Arabia and Syria mark a significant shift in regional dynamics. They are operational and detailed, driven directly by Riyadh’s Ministry of Energy. Major companies such as TAQA, ADES Holding, Arabian Drilling, and the Arabian Geophysical and Surveying Company (ARGAS) are set to provide technical support and field development in both the oil and gas sectors. ARGAS will conduct seismic surveys, while Arabian Drilling will supply rigs and workforce training. TAQA will manage integrated solutions for oil and gas field construction, and ADES Holding will focus on enhancing output in five key gas fields: Abu Rabah, Qamqam, North Al-Faydh, Al-Tiyas, and Zumlat al-Mahar.

These developments follow earlier efforts by the United Arab Emirates, which had taken the lead in revitalizing Syria’s gas sector. On November 12, 2022, Dana Gas entered into a preliminary agreement with Syria’s state oil company to redevelop critical fields. Together, these Gulf initiatives are aligned with a broader strategy involving U.S. companies such as Baker Hughes, Hunt Energy, and Argent LNG, who are working on plans to rebuild Syria’s energy and power sectors, especially in regions west of the Euphrates River.

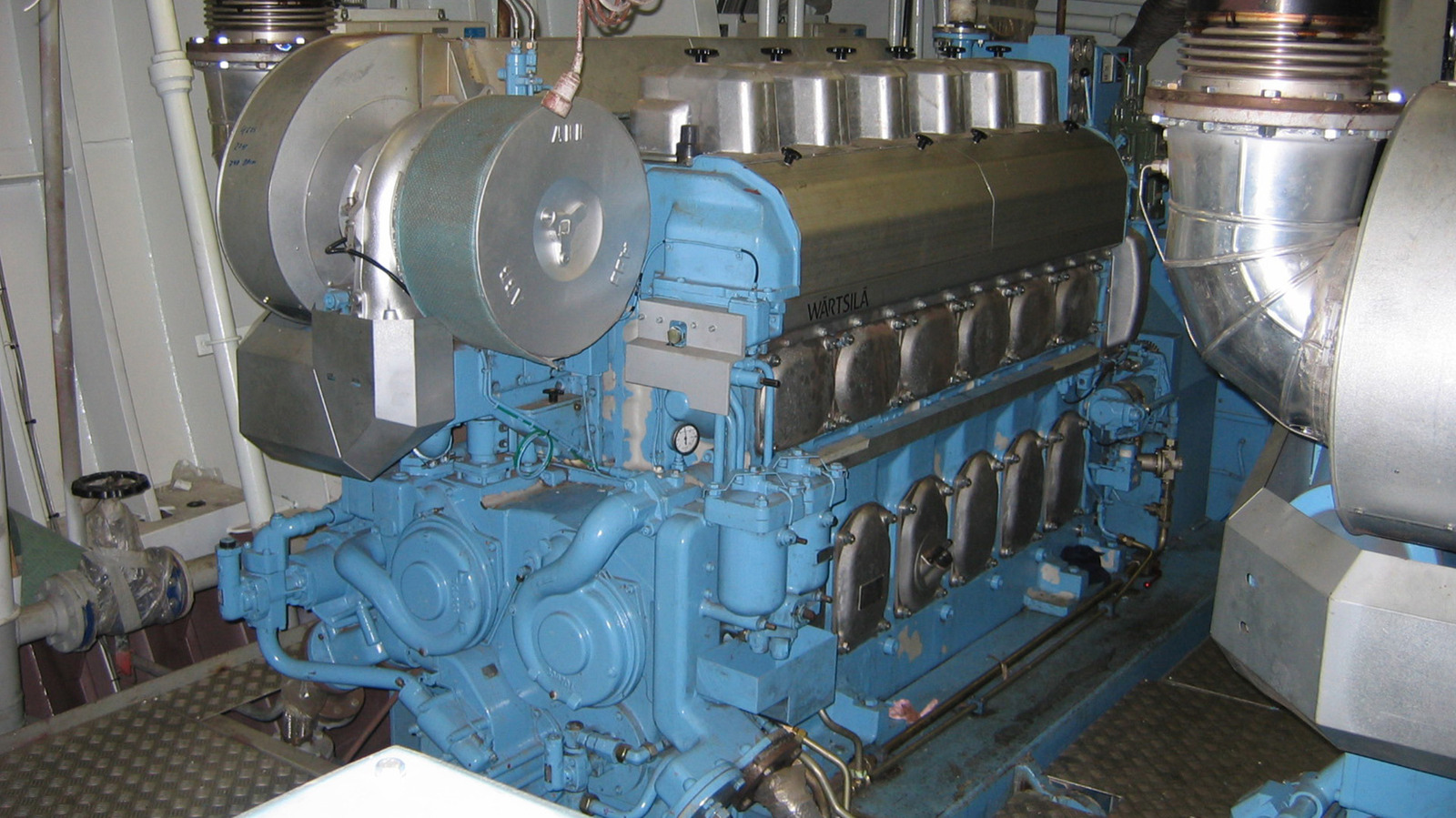

Syria’s energy sector, despite years of civil war, still holds substantial potential. Before the conflict, the country produced about 316 billion cubic feet of dry natural gas daily and possessed proven reserves of 8.5 trillion cubic feet. Russian involvement had facilitated initial development in the South-Central Gas Area, boosting output by approximately 40% before the war intensified. Oil and gas exports accounted for a quarter of Syria’s government revenues, positioning it as a leading hydrocarbon producer in the eastern Mediterranean.

In 2015, after Russia’s military intervention, Moscow and Damascus signed the Cooperation Plan, which aimed to restore numerous energy facilities and expand the power sector. This included key infrastructure projects designed to rejuvenate Syria’s energy landscape and regain control for the Damascus government.

The 2015 plan also encompassed upgrades to the Homs refinery, with ambitious targets to increase capacity significantly in subsequent phases. Prior to the onset of the civil war, Syria produced around 400,000 barrels per day from proven reserves of 2.5 billion barrels. This production level had previously been as high as 600,000 barrels per day before the decline due to outdated recovery techniques.

As the geopolitical landscape shifts, Syria remains a crucial asset for Russia, offering a Mediterranean foothold that enhances its military and economic influence in the region. The Kremlin has sought to expand its presence through military bases and energy investments, leveraging Syria as a platform for broader regional ambitions, including arms sales and intelligence operations.

In the context of the new agreements, the restoration of Syria’s energy infrastructure is not merely about rebuilding; it reflects a strategic move to diminish Russia’s foothold in the region. With a shift towards a reconstruction model supported by Arab nations and Western firms, Washington aims to re-establish its influence, countering the long-standing ties between Russia, Iran, and Syria.

The emergence of this new energy framework in Syria underscores a significant transition in regional alliances. The UAE and Saudi Arabia are positioned as key players, legitimizing the reconstruction efforts, while Western companies provide the necessary expertise to facilitate this transformation. This collaboration not only signals a strategic realignment but also opens the door for broader normalization efforts within the region, aligning with the interests of the United States and its allies.

As international actors navigate this evolving landscape, the implications for energy security and geopolitical stability in the Middle East will be closely monitored.